During the year Michael and I issue various opinions about stocks that we feel strongly about. We do this whether we have purchased/sold them in our personal accounts, or just because we feel strongly about the direction a stock will take but aren’t in a position to capitalize. We have been writing this blog for a several months now and feel it would be instructive to analyze our picks and determine what worked and what didn’t, and provide our current insight on those stocks. Current market prices will be taken from the close of market today, January 7th, 2010.

During the year Michael and I issue various opinions about stocks that we feel strongly about. We do this whether we have purchased/sold them in our personal accounts, or just because we feel strongly about the direction a stock will take but aren’t in a position to capitalize. We have been writing this blog for a several months now and feel it would be instructive to analyze our picks and determine what worked and what didn’t, and provide our current insight on those stocks. Current market prices will be taken from the close of market today, January 7th, 2010.

Some That Went Well:

B SHAW @ 28.20: I bought the Shaw Group (SHAW) on October 16, a day where they got hit hard by a number of events. Shaw just announced earnings which beat expectations, taking their stock to $32.36, for a return of about 16% in 3 months. I saw them then, just as I do now, as an undervalued and under-appreciated infrastructure play with a nuclear energy kicker.

B BNI @ 79.20: I bought Burlington Northern Santa Fe (BNI) on October 1. I was looking at a cyclical play as the economy recovered, I figured that rail was going to see a huge rebound as the economy recovered. What would be the chief driver of this? The efficiency of rail, as energy prices rise (another bet I am taking), rail will become more and more attractive relative to other methods of over-land material shipping. Towards the end of last year, Warren Buffet announced that he was buying the rest of the BNI shares he didn’t already own for $100/share, and the stock rose to that level generating a return of 26% in 2 months. I eventually sold that position instead of receiving the equivalent in BRK.B shares.

S PALM @ 17.40: I nailed this one. I didn’t own the stock, so I couldn’t sell it, but had investors heeded my warning they would have saved themselves from 34% of downside given the current price of $11.45. I wrote this as PALM was riding high on the prospects for the Pre smartphone, but I saw the dark clouds on the horizons. With Google releasing their Nexis One yesterday, if puts another nail in the coffin of Palm’s WebOS, as the ability for manufacturers to customize Android, and the immense Apple App store, give massive advantages over Palm’s new system.

S GRMN @ 37.63: This is another one that I didn’t own and so couldn’t sell, but the stock is now 17% below the price at which I recommended selling. Again, this is smartphone related as GRMN released their Nuvi to much hype, but little substance. GRMN is losing marketshare to smartphone applications like on the iPhone, Motorola Droid and Google Nexis One, and this is a trend that will continue. The Nuvi was supposed to help, but it was a confused hybrid between stand-alone GPS and a smartphone that made a mess of both functions. Investors will do well to continue to stay clear.

B RIMM @ 56.60: Mike nailed this price for RIMM. He used discounted cash flows analysis to determine that it was severely undervalued, and that turned out to be the case. RIMM is currently trading at approximately $65, for an upside of about 16% in the 2 months since his article was published. RIMM is the biggest player in the smartphone market, and their strength will likely continue as they release new products that are competitive with the other market leaders.

S RIMM @ 83.60: Again, Mike nailed this one. With a current price of $65, Mike saved himself and any readers who heeded his warning from 28% of downside over the course of 3 months. His hypothesis was that expectations for performance had outstripped actual results, and that was the case as RIMM reported earnings that disappointed.

There was also Mike’s December 17th post, on Meredith Whitney’s calls on Goldman Sachs & Co. (GS), Morgan Stanley (MS), and JP Morgan Chase & Co. (JPM) where he proposed that it would likely be profitable to ignore her calling considering that the stocks had already fallen quite a bit and that even with her lower earnings estimates, they still represented great values at their prices at the time. Mike has so far been proved correct, and all three are up by 10%, 13% and 11% respectively in the two weeks since his post. All returns are more than doubling the 4% gain of the S&P 500.

And Some That Did Not Go So Well:

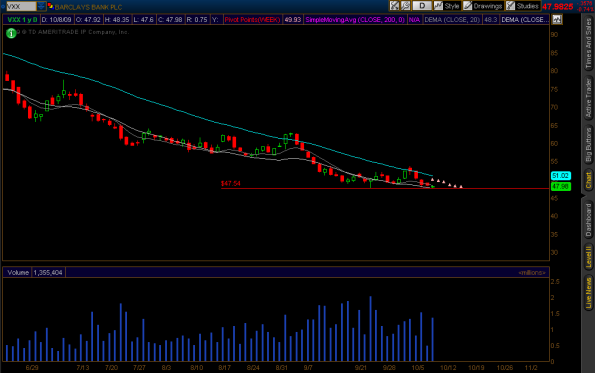

B VXX @ 48.30: The problem was not the argument, but the vehicle chosen to execute that argument. VXX is an ETF that is designed to follow the short-term VIX futures contract price. The problem is, it doesn’t. Since my article was posted, this ETF is down 37%. Luckily I got out pretty quickly (at $45.96), but in retrospect this was a horrible idea.

S AAPL @ 189.59-190.00: Our hypothesis on this article (which incidentally got us a note from Apple’s lawyers…check out the original post) was that AAPL had fully priced in any future good news, and was excluding the possibility of poor performance. A week after our original article, Apple released record earnings, and the stock shot up to above $200. It has shown volatility since then, but now stands at $210 for a missed upside of about 10%. We stand by our convictions, but with the utmost respect for AAPL’s continued performance.

B RIMM @ 70.07 and 67.20: After RIMM missed earnings on September 25, the stock dropped by 15% in a day. I bought that dip, and Mike bought a few days later. I underestimated the investor disappointment concerning earnings, and bought way too early. The fallout from earnings hadn’t happened yet, and the stock would eventually settle in the mid $50s before recovering. At its current price of $65, the decline isn’t so painful but it definitely hurt for a while.

B BAGL @ 10.12: Mike found this one while searching through relatively unwatched industries for low-beta stocks that were severely undervalued on a cash flow basis to their peers. It is currently down only 4% but this is following a more than 11% gain off of where it fell in the mid-8’s. Einstein Noah Restaurant Group continues to trade at less than half a years revenue even though the company is still growing. Mike still feels it offers a very compelling value especially compared to it’s peers, however, he recognizes that it was probably a mistake to dive in until there was a potential catalyst to drive the stock higher considering that they don’t even pay a dividend.

—

I hope readers find this constructive. I find it is helpful to go back and learn from both your mistakes and successes. In general, I feel that we have done quite well in picking stocks on both sides of the trade.

-AH

Disclosure: Andrew is long RIMM and SHAW. Michael is long BAGL, BAC and net long the market although currently building a position in SH.

Reviewing Our 2009 Trades (AAPL, RIMM, GS, JPM, MS, SHAW, BNI, BAGL, PALM, GRMN, VXX, SH)

Some That Went Well:

B SHAW @ 28.20: I bought the Shaw Group (SHAW) on October 16, a day where they got hit hard by a number of events. Shaw just announced earnings which beat expectations, taking their stock to $32.36, for a return of about 16% in 3 months. I saw them then, just as I do now, as an undervalued and under-appreciated infrastructure play with a nuclear energy kicker.

B BNI @ 79.20: I bought Burlington Northern Santa Fe (BNI) on October 1. I was looking at a cyclical play as the economy recovered, I figured that rail was going to see a huge rebound as the economy recovered. What would be the chief driver of this? The efficiency of rail, as energy prices rise (another bet I am taking), rail will become more and more attractive relative to other methods of over-land material shipping. Towards the end of last year, Warren Buffet announced that he was buying the rest of the BNI shares he didn’t already own for $100/share, and the stock rose to that level generating a return of 26% in 2 months. I eventually sold that position instead of receiving the equivalent in BRK.B shares.

S PALM @ 17.40: I nailed this one. I didn’t own the stock, so I couldn’t sell it, but had investors heeded my warning they would have saved themselves from 34% of downside given the current price of $11.45. I wrote this as PALM was riding high on the prospects for the Pre smartphone, but I saw the dark clouds on the horizons. With Google releasing their Nexis One yesterday, if puts another nail in the coffin of Palm’s WebOS, as the ability for manufacturers to customize Android, and the immense Apple App store, give massive advantages over Palm’s new system.

S GRMN @ 37.63: This is another one that I didn’t own and so couldn’t sell, but the stock is now 17% below the price at which I recommended selling. Again, this is smartphone related as GRMN released their Nuvi to much hype, but little substance. GRMN is losing marketshare to smartphone applications like on the iPhone, Motorola Droid and Google Nexis One, and this is a trend that will continue. The Nuvi was supposed to help, but it was a confused hybrid between stand-alone GPS and a smartphone that made a mess of both functions. Investors will do well to continue to stay clear.

B RIMM @ 56.60: Mike nailed this price for RIMM. He used discounted cash flows analysis to determine that it was severely undervalued, and that turned out to be the case. RIMM is currently trading at approximately $65, for an upside of about 16% in the 2 months since his article was published. RIMM is the biggest player in the smartphone market, and their strength will likely continue as they release new products that are competitive with the other market leaders.

S RIMM @ 83.60: Again, Mike nailed this one. With a current price of $65, Mike saved himself and any readers who heeded his warning from 28% of downside over the course of 3 months. His hypothesis was that expectations for performance had outstripped actual results, and that was the case as RIMM reported earnings that disappointed.

There was also Mike’s December 17th post, on Meredith Whitney’s calls on Goldman Sachs & Co. (GS), Morgan Stanley (MS), and JP Morgan Chase & Co. (JPM) where he proposed that it would likely be profitable to ignore her calling considering that the stocks had already fallen quite a bit and that even with her lower earnings estimates, they still represented great values at their prices at the time. Mike has so far been proved correct, and all three are up by 10%, 13% and 11% respectively in the two weeks since his post. All returns are more than doubling the 4% gain of the S&P 500.

And Some That Did Not Go So Well:

B VXX @ 48.30: The problem was not the argument, but the vehicle chosen to execute that argument. VXX is an ETF that is designed to follow the short-term VIX futures contract price. The problem is, it doesn’t. Since my article was posted, this ETF is down 37%. Luckily I got out pretty quickly (at $45.96), but in retrospect this was a horrible idea.

S AAPL @ 189.59-190.00: Our hypothesis on this article (which incidentally got us a note from Apple’s lawyers…check out the original post) was that AAPL had fully priced in any future good news, and was excluding the possibility of poor performance. A week after our original article, Apple released record earnings, and the stock shot up to above $200. It has shown volatility since then, but now stands at $210 for a missed upside of about 10%. We stand by our convictions, but with the utmost respect for AAPL’s continued performance.

B RIMM @ 70.07 and 67.20: After RIMM missed earnings on September 25, the stock dropped by 15% in a day. I bought that dip, and Mike bought a few days later. I underestimated the investor disappointment concerning earnings, and bought way too early. The fallout from earnings hadn’t happened yet, and the stock would eventually settle in the mid $50s before recovering. At its current price of $65, the decline isn’t so painful but it definitely hurt for a while.

B BAGL @ 10.12: Mike found this one while searching through relatively unwatched industries for low-beta stocks that were severely undervalued on a cash flow basis to their peers. It is currently down only 4% but this is following a more than 11% gain off of where it fell in the mid-8’s. Einstein Noah Restaurant Group continues to trade at less than half a years revenue even though the company is still growing. Mike still feels it offers a very compelling value especially compared to it’s peers, however, he recognizes that it was probably a mistake to dive in until there was a potential catalyst to drive the stock higher considering that they don’t even pay a dividend.

—

I hope readers find this constructive. I find it is helpful to go back and learn from both your mistakes and successes. In general, I feel that we have done quite well in picking stocks on both sides of the trade.

-AH

Disclosure: Andrew is long RIMM and SHAW. Michael is long BAGL, BAC and net long the market although currently building a position in SH.